How much of an emergency fund should I have?

An emergency fund helps cover unexpected expenses, prepare for a potential loss of income, break the debt cycle, and ensure your investments can reach their full potential. You should fund your emergency fund [...]

What is High-interest Debt?

High-interest debt is generally considered any debt with a double digit annual interest rate (e.g. 10% or greater). The most common type is credit card debt but personal loans, private student loans, auto [...]

Automatically Fund Your Emergency Fund Account

From your regular day-to-day checking account, set up an automatic, recurring transfer to your dedicated emergency fund account. Look for the “Transfer” link (or similar), confirm your emergency fund account is a linked [...]

How to Set Up Your Emergency Savings Fund

Your emergency fund savings should be in a dedicated account and not commingled with your day to day spending account. Find an account that ensures your emergency fund savings are fully liquid – [...]

Get Health Insurance & Write Down Policy Details

If your employer offers health insurance, sign up for a plan when you start your job (no need to wait for an open enrollment period). If you cannot get health insurance through a [...]

Setup Reminder to Review Charges & Payments

Find out when your monthly credit or debit card statements come in (see “Pro Tip!” in details below) and set a reminder to review your statement. This task shouldn’t take more than five [...]

How to Evaluate Your Health Insurance Needs

Everyone should have health insurance. To evaluate your health insurance needs it’s important to understand the key terms including premium, deductible, copayment, coinsurance, and out-of-pocket max. Consider the three “W”s: Who is the [...]

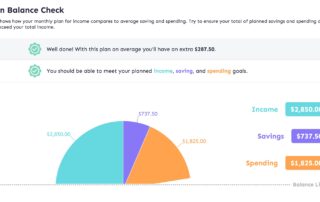

Setup Financial Automation

In the notes section above (available to logged in users): Write out your financial automation strategy based on the guidelines below Link your accounts held at different institutions Set up the recurring payments [...]

The Importance of Health Insurance

Without health insurance you are likely to receive worse health care. When you do need health care, you may be stuck with bills that are significantly higher than what it would have cost [...]

Build a Mindset for Financial Security

Your "Financial Security" mindset centers around three key concepts: Protecting what you have - e.g. your health, identity, and accounts Preparing for the unexpected - e.g. by building an emergency fund Fervently attacking [...]