MoneySwell Search Results

Ryan’s Blog Post Test

Put your Quick Look content here! Put your blog post/article content here. Remember that H3 Headings are what form your table of contents. H3 Heading Example #1 Text [...]

How much of an emergency fund should I have?

An emergency fund helps cover unexpected expenses, prepare for a potential loss of income, break the debt cycle, and ensure your investments can reach their full potential. You should fund your emergency fund [...]

Calculate Your Emergency Fund for Independence

To calculate your emergency fund, you need to consider both the purpose of the fund and the expenses you hope it will cover. Review examples of common purposes and expenses below. For expenses, determine [...]

A Six Month Emergency Fund & Beyond

An emergency fund larger than six months of living expenses isn't always essential. However, personality, life circumstances, the purpose of the fund, or other financial goals, may make an emergency fund larger than [...]

Fully Funded Emergency Fund

Earlier you determined the dollar amount your “Independence Level” emergency fund should be. If you’ve reached that dollar amount in your emergency fund account, you can check this off your list! [...]

Adjust Your Emergency Savings for Financial Independence

Much like you did when you adjusted your savings during the Growth stage, you’ll want to follow the same steps this time. This means… Determine how much you can adjust your savings transfer [...]

Automatically Fund Your Emergency Fund Account

From your regular day-to-day checking account, set up an automatic, recurring transfer to your dedicated emergency fund account. Look for the “Transfer” link (or similar), confirm your emergency fund account is a linked [...]

How to Set Up Your Emergency Savings Fund

Your emergency fund savings should be in a dedicated account and not commingled with your day to day spending account. Find an account that ensures your emergency fund savings are fully liquid – [...]

Fund Your Emergency Fund to Your Growth Level

In the Growth stage of financial maturity, you should grow your emergency fund to cover three to six months of expenses. (You should aim for 1-3 months in "Security", and 6 months to [...]

Adjust Automatic Savings to Your Emergency Fund – Growth Level

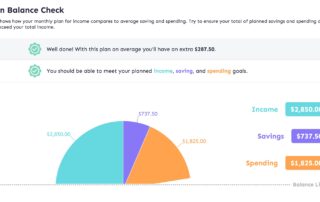

MoneySwell's tools can help you determine how much more you can afford to put toward your emergency fund. (See below.) If it’s not clear if you can afford to increase your automatic transfer [...]