Quick Look

- Micro Investing allows you to invest small amounts of money consistently over time.

- The amount invested is often the rounded-up difference between a given transaction and the next whole dollar. For example, a purchase ending in .75 would produce a rounded-up investment amount of 25 cents.

- Micro investing can be a good way to get started but shouldn’t be a primary way to save for retirement – it won’t produce enough for a long-term nest egg.

Contents

Micro-investing is a relatively common way to start saving and investing. In this article, we’ll detail what micro-investing is, its benefits, and its drawbacks.

What is Micro-investing?</span>

Have you ever paid for a cup of coffee and tossed your change in the tip jar? Micro-investing is kind of like tipping your spare change. Except with micro-investing, you’re tipping yourself, and instead of just saving the tips, you’re investing them.

Using your spare change to get started with investing is a fine start, but it’s important to go further and save more.

Micro-investing typically* works by rounding up each debit card transaction to the nearest dollar and using those funds to purchase fractional shares of different investment products, often ETFs. The idea is that it’s an easy and relatively pretty painless way to make consistent, small investments. Over time, the hope is that the value of your shares grows.

* Some micro-investing services don’t use the rounding up strategy. Instead they give you rewards, say “1% of purchases”, and invest those rewards on your behalf. In this article, we focus on the rounding up strategy. But the key takeaways will be the same.

How do you get started with micro-investing?

You can start micro-investing by opening an account with an institution that does it. Two popular micro-investing platforms are Stash and Acorns but there are others. Note that you’ll likely pay a monthly fee and $3 to $9 is common.

From there, it’s business as usual from a spending standpoint. You will receive a debit card linked to your checking account that you can use like any other card.

However, when you spend, a portion of your spending is either rounded up to the nearest dollar and invested, or you receive a “stock reward.”

Here are two examples:

- Round Up: Using your debit card, you buy a coffee and muffin for $6.45. This transaction rounds up to $7.00, and the full amount is withdrawn from your checking account. But 55 cents of this transaction is invested.

- Stock Rewards: Using your debit card, you buy a coffee and a muffin for $6.45. 1% of that transaction, about 6 cents in this case, is given to you as a reward in the form of a stock purchase.

What are the benefits of micro-investing?

There are two major benefits of micro-investing.

First, micro-investing is an easy way to invest without spending a lot of money. In years past, initial deposits for mutual funds were commonly $1,000 or even more. More recently, it’s become quite easy to find a variety of funds with low fees and no minimum investment requirement. From this standpoint, whether you’re explicitly micro-investing or purchasing fund shares on your own, a lack of significant cash on hand shouldn’t be a barrier.

The second major benefit of micro-investing is that it can offer an easy way to invest without a lot of investing knowledge. Even for those who understand the value of broad market index funds compared with individual stocks, the truth is you still need to make the selection of which fund to invest in. For new investors this can be intimidating.

Most mico-investing platforms solve this problem by recommending a portfolio for you based a few basic inputs. These may include your age, time horizon, income, goals, and risk tolerance. From there, the micro-investing platform will do the rest by purchasing shares (or fractions of shares) from a range of portfolios.

What are the drawbacks of micro-investing?

There are two potential drawbacks of micro-investing.

First, micro-investing may cause you to delay taking action on more significant investing strategies. Did you ever start a project well in advance but still found yourself pulling an all-nighter right before the due date? Sometimes this happens because when we’ve done something, we can create a sense of complacency even though we have much more to do. If this sounds like you, be wary of micro-investing.

The reason, is that investing generally works best when it has more time to grow and compound. So while starting with micro-investing today is better than nothing, if it causes you to delay more significant investing by many years, you may regret it. See point #2 below.

The second drawback to mico-investing is that it’s not likely to produce very much. Put simply, micro-investing produces “micro results.” You need to save more.

Let’s go through a simple micro-investing example for the “round-up” approach.

- On average, let’s say you have 5 transactions per day

- On average, you will have a 50¢ round-up value (some will be 1¢ and others will be 99¢ but over time it will average to 50¢)

- 50¢ x 5 transactions x 365 days per year = $912.50 in annual savings

- If you continued this strategy for 30 years, you will have invested about $27,374 of your own money. Assuming an annualized 7% rate of return, your investments would be worth close to $93,000.

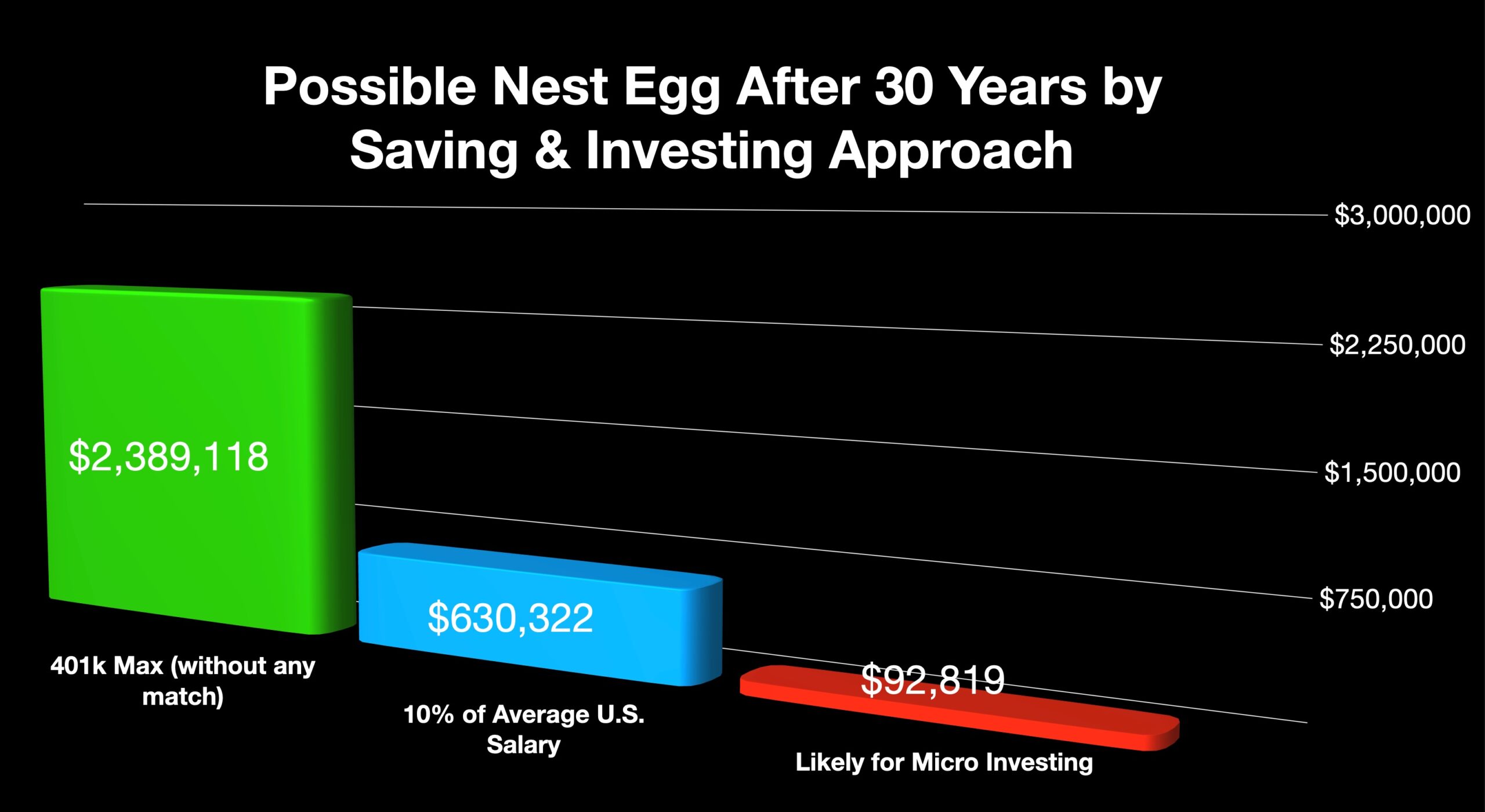

How does $93k compare to the results of other investing strategies?

While $93k might sound like a lot of money, how does it compare to other approaches?

- Saving 10% of Annual Average U.S. Salary: The average salary in the U.S. is about $62k annually. Many experts recommend saving at least 10% of your salary. This works out to saving about $6,200 annually. At a 7% return for 30 years, you would have about $630,322. That’s nearly 579% more in your nest egg compared to a micro-investing-only approach.

- Maxing out a 401k: The 2025 401k maximum contribution is $23,500. Even if we assume no employer matching contributions, and no increases to your contribution amount (even though the contribution limit is raised over time), with a 7% annualized return for 30 years, your nest egg would be worth about $2,389,118. This works out to about 2,474% more in your nest egg compared to a micro-investing-only approach.

A 2024 survey found that for Americans with retirement accounts, they estimated they would need $1.87 million to retire, adjusted for inflation. When you consider this, $93,000 doesn’t seem like much.

The “Net Net” on Micro-investing

If micro-investments help you get started and don’t delay you from saving and investing larger sums in other ways, there’s nothing wrong with that. After all, something is better than nothing. But, while “investing your spare change” is a nice tagline, it’s not a strategy for long-term financial success.

To learn about the financial steps you should be taking for long-term financial success, the MoneySwell Financial Priorities Action Plan can help. It’s your personalized financial checklist no matter where you are in your financial journey. It can help you understand how to balance debt payments alongside investing for your future and so much more.

And if you’re interested in understanding how much you might need for your retirement, use the free MoneySwell Retirement Planner (and sign up for an account if you want to track your progress over time).

Related Videos