MoneySwell Search Results

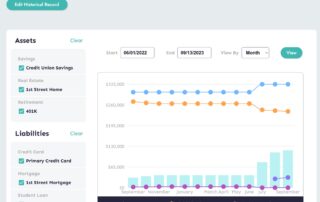

Set Up An Assets & Liabilities Dashboard

Use your Assets & Liabilities tool to track all your bank account values in one place. "Linked" accounts can be synced with your institution with a single click. "Manual" accounts allow you to [...]

Crunch Your Numbers

Using a debt payoff calculator can help you determine if debt consolidation is a good idea for your circumstances. Don't include debts you pay off every month in your calculation - e.g. a [...]

How to Consolidate Credit Card Debt

Credit card debt consolidation takes revolving balances from multiple cards and puts them into a single loan or line of credit. It should have a lower average interest rate (which saves you money), [...]

Your Financial Priorities Action Plan

The Financial Priorities Action Plan helps you build your personal finance literacy, take action, and get ahead. Your plan can be customized based on where you are in your financial journey by completing [...]

Pay off all Medium-interest Debt

Once you pay off your medium-interest debt you can start putting some or all that money toward medium-term savings goals like vacations, major purchases, or long-term savings goals like retirement. [...]

Install Your Password Manager’s Web Browser Extension

A browser extension is an and easy way to access your password vault without having to visit your password manager's website or app. Install extensions by clicking a link on your password manager's [...]

Debt Consolidation Checklist

Review this article to confirm if debt consolidation makes sense for you. If consolidation makes sense for your circumstance, follow the links to the subtasks below. If you've determined [...]