Quick Look

- A credit score is primarily used by lenders to understand how likely you will be to repay a loan.

- A higher score usually means paying less in interest when buying something with credit (like a car or a house).

- The most impactful way to improve your score is by paying bills on time and not accumulating too much debt.

- Checking your score regularly is healthy but there’s no need to obsess over every point.

- If you practice good financial habits your score will go up over time.

There’s a wealth of information from reputable sources about credit scores and credit reports (including articles like this from the FTC). But for your convenience, we’ve summarized the most important details below.

There’s a wealth of information from reputable sources about credit scores and credit reports (including articles like this from the FTC). But for your convenience, we’ve summarized the most important details below.

What is a Credit Score?

Your Credit Score is a number that impacts the interest rates you pay any time you borrow money (like if you borrow money to buy a car or a house or have a credit card). Generally, the lower your score, the higher your interest rate, and the more you’ll ultimately have to pay when you buy something using a loan. The higher your score, the lower your interest rate and the less you’ll have to pay.

Importantly, credit scores and reports are not only used by people who are considering lending you money. They are also used by potential employers, landlords etc. to get a sense of your level of responsibility.

Why You Should Check Your Score

Checking your score and/or report can help you spot errors or outright fraud. For example, an unpaid balance on a fraudulently opened card would cause your score to drop. Additionally, knowing your score can help you discover loans or credit cards you may be eligible for. You want to ensure you’re getting the best rates on loans and the best rewards on cards you’re eligible for.

Credit Reporting Bureaus

There are three bureaus that report your score: Experian, Equifax, and TransUnion. While their exact formulas slightly differ, assuming they have the same data, your scores from each should be pretty close.

The Difference Between Your “Credit Score” and “Credit Report”

Your score is simply a number and the report shows the details of why you have that score. The report includes things like when you’ve applied for a loan or line of credit, your existing debt, and associated debt payment history. Depending on who’s checking, they will either get access to your score or a version of your credit report. For example, potential employers can get an “Employment Insight Report” that contains less information than a report you pull for yourself and these reports never contain your credit score.

Credit Score Ranges

Credit scores range from 300 up to 850 and higher scores are always better. That being said, in most instances a few points up or down will not make a difference. Before applying for a loan or line of credit, ask the lender what credit range will get you a particular rate. If you’re well above that range you don’t need to worry about a few points here or there. If you’re below it, you know what you need to shoot for.

Factors that Affect Your Credit Score

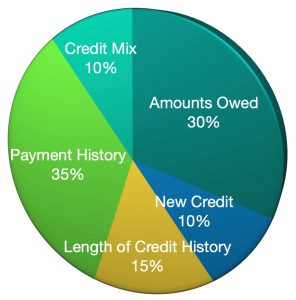

Every credit reporting agency has a slightly different formula. But each uses an element of the five factors listed here. In order of importance they include:

-

Payment History

This is the most important factor. In fact, even a single missed payment can be detrimental. This is why it’s so important to at least pay the minimum owed every single time. If your payment is late, you will be charged a fee (boo!), but it won’t count as “missed” until it’s 30 days late.

-

Amount Owed

This is usually based on a “credit utilization ratio” across all your accounts. In other words, if you owe $5,000 and your total available credit is $15,000, your utilization ratio is 33.3%. The lower the ratio the better because it shows you know how to use only what you need. A utilization ratio above 30% tends to be seen negatively and those with the highest credit scores tend to have ratios in the single digits.

But remember that your credit score is a snapshot in time. Therefore if you look at your score right before you pay your credit card bill, it will be worse than if you check after you pay your bill. Keep this in mind before applying for a loan and make sure to pay off any balances you can before having your credit pulled. -

Credit History

The longer your credit history, the better. However, before the young folks get upset about not having had the chance to develop a long history, remember that this factor is only about half as important as the first two. Credit history is usually based on the average age of all your credit accounts. Therefore make sure you keep your oldest credit card open (even if you don’t use it) since this line of credit will increase the average credit history length.

-

Credit Mix

Handling different types of credit responsibly is another sign that you are responsible. A diversified mix of credit could include credit cards, student loans, auto loans, a mortgage etc. Does this mean you need to acquire more debt to diversify your credit mix? Not necessarily. But if you plan on using debt at some point (e.g. to buy a home), be aware that you may want to build a history with a mix of credit types even if you only use some sparingly.

-

New Credit & “Hard” Inquiries

Opening a bunch of new credit or having a bunch of “hard inquiries” from lenders, negatively affects your score. Fortunately, these impacts only last a short time and shouldn’t impact your score very much. Additionally, if you’re shopping for a mortgage, note that you have a special 45 day window. During this time, all of the inquiries from potential lenders will only count as one. As a result, this gives you the ability to comparison shop without making your score worse as you go.

Your credit score will take care of itself if you do the right things. Give it time.

Your Credit Score Matters…But Only Up to a Point

Your score is good for showing lenders, landlords, and employers that you’re responsible. But it’s not good for things like impressing your date or cocktail party conversation. And nobody is going to give you a trophy when it reaches a certain point. In fact, the personal finance industry focuses way too much on the credit score. Just check your score and report for errors and be aware of your score’s impact when applying for credit. If you do the right things in the rest of your financial life, your score will improve in the long run.