Quick Look

- In the Growth stage of financial maturity, you should grow your emergency fund to cover three to six months of expenses. (You should aim for 1-3 months in “Security”, and 6 months to 1 year in “Independence.”)

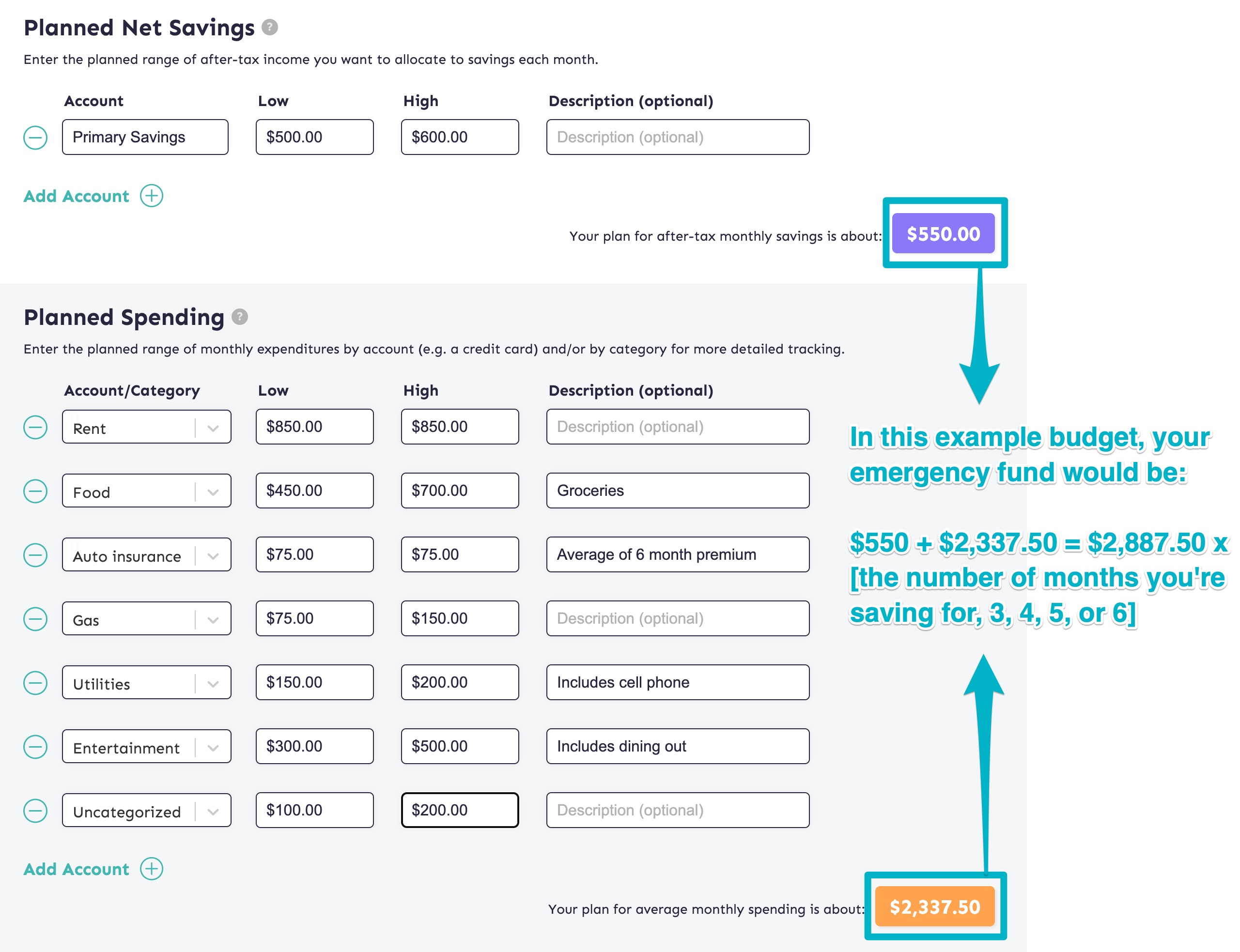

- You can use the “Plan” tab in MoneySwell’s Budget Planner tool to easily estimate your expenses for three to six months.

Contents

This article will show you how to use MoneySwell’s Budget Planner tool and determine the dollar amount for a a three to six month emergency fund goal.

Estimate Your Planned Expenses with a Budget

You can use the Plan tab of Budget Planner to estimate your planned savings and spending. You can track spending by spending category, or, by account (i.e. I typically spend this much from this account each month).  Follow these steps:

Follow these steps:

- Enter the amount you would like to save in a given month.

- Enter the amount you typically spend each month from all of your accounts – or – enter your spending on a per-category basis.

- Add your total savings and total expense numbers together.

- Multiply that by number 3,4,5 or 6 (whatever the number of months you’re hoping to save for is).

You now have three to six months worth of planned savings and expenses. This is your Emergency Fund Growth savings goal.

Track Your Actual Expenses Using the Review Tab

If you have been using Budget Planner for multiple months, you can use the data of your actual spending from the Review tab. Since this represents actual spending, it may provide the most accurate representation of what you’ll need for a 3-6 month emergency fund. After entering however many full months (partial months entries will distort your numbers) of actual saving and spending data you want in the Update tab, go to the Review tab and follow these steps:

- On the Update tab, ensure you have entered multiple months of accurate spending records. (We recommend at least three.)

- Go to the Review tab and add your total saving and total spending from the graph.

- Divide that number by however many full months of data you have. This will give you your actual average monthly savings and expenses.

- Multiple that number by 3, 4, 5, or 6 (whatever number of months you’re hoping to save for).

You now have three to six months worth of actual saving and expenses. This is your emergency fund Growth savings goal.

Why include the “savings” number in your Emergency Fund goal?

It’s easy to forget and can even seem counterintuitive to include a “savings” number in your calculation for your emergency fund goal. But there are great reasons to do this. Here are two.

One – Health Insurance is a Cost

For many people, an emergency fund acts like a job loss fund. That is to say, “If I lost my job tomorrow, how long could I survive before I needed to start earning income again?” But for many Americans, a job provides more than income; it provides health insurance. And health insurance costs money. Remember: even if you pay for some of your health insurance, whether you’ve realized it or not, many employers will pay for part of those costs on your behalf (this should show up on your paystub if you get health insurance through your employer).

A full accounting of expenses may include the full cost of health insurance – something you would have to bear if you lost your job.

If you lose your job, you’ll need to pay those costs yourself or pay for a new health insurance plan. Either way, by including savings in your calculation, you’re giving yourself extra cushion for expenses you may not have been thinking about.

Two – Keep Your Savings on Track

The idea of an emergency fund is to keep you “on track” when something unexpected happens. Staying “on track” may mean not having to go into credit card debt. Or it may mean not having to sell retirement investments in order to make ends meet. But one of the most important things to keep “on track” is your savings plan.

Your savings plan may include long-term goals like retirement, or medium-term goals like vacations or a new car. But whatever you’re saving for, by including that number in your calculation at the outset, you’re making your emergency fund that much larger and stronger should something go awry.

Conclusion

A 3-6 month emergency fund will give you a new level of confidence…even on the inevitable rainy day.

Fully funding an emergency fund at the Growth stage is a major accomplishment. If you’ve accomplished this, well done! If you’re on your way there, don’t shortchange yourself by being too optimistic and saving less than you ought to. Assume the worst and if things turn out not to be so bad, you won’t mind that you had built in a little extra buffer!